Is it worth investing in Worldcoin and partaking in this project created by Sam Altman? The answer may surprise you.

As a retail investor, it’s essential to conduct thorough research before jumping into any investment opportunity, especially in the volatile world of cryptocurrencies. In this article, we delve into the reasons why investing in Worldcoin ($WLD) might not yield profitable returns, even though it’s a token made by the biggest AI company in the world (OpenAI).

While it is tempting to join the hype and fear of missing out (FOMO) surrounding this project, we aim to present a balanced view of its potential pitfalls. Despite being backed by OpenAI CEO Sam Altman, there are several factors that suggest Worldcoin might face significant challenges.

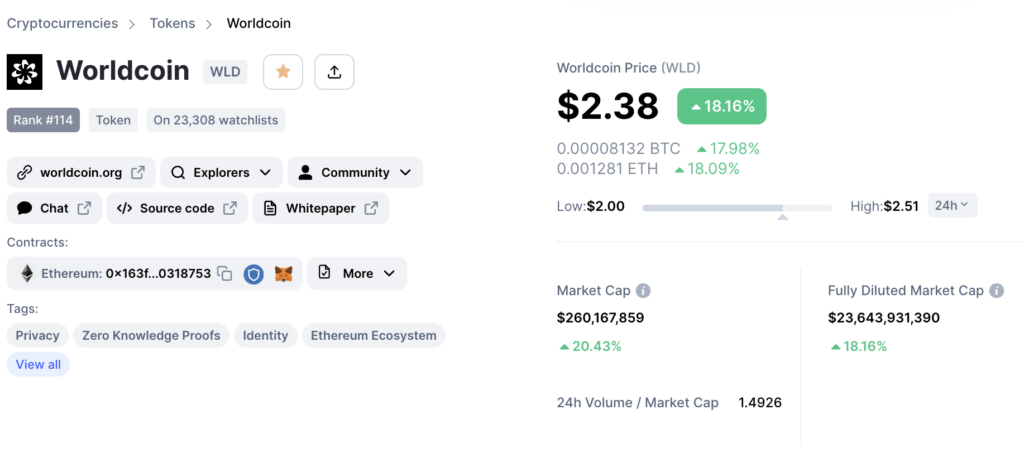

1. Extreme Initial Market Cap

Worldcoin’s fully diluted initial market cap of $20 to $30 billion is undoubtedly ambitious, but it also raises eyebrows. Similar large billion-dollar coins have yet to generate substantial returns for investors.

Such extreme valuations can be speculative and risky, making it crucial for investors to carefully evaluate the coin’s underlying value and potential for growth. Usually, projects start with a market cap that is less than $500 million, not $20 billion.

2. Suspicious Tokenomics

One of the concerning aspects of Worldcoin’s tokenomics is the allocation of its coins. With 80% of coins meant for distribution among 8 billion people and only 20% reserved for investors and the project’s team (potentially consisting of 200–500 people), the allocation seems disproportionate.

Read more: 14 Apple’s Next Products (Parody): What’s the Next Big Thing?

The allure of owning a significant portion of a $20 billion is undeniable, but this skewed distribution model could impact the project’s long-term viability. It doesn’t seem to be fighting income inequality. Instead, it seems to be widening the gap between the rich and poor.

3. Sam Altman’s Expertise Gap

While Sam Altman has a commendable background in machine learning and artificial intelligence, his lack of experience in the crypto industry is noteworthy.

Cryptocurrencies and blockchain technology require a nuanced understanding of the market’s intricacies and dynamics, which might be different from traditional tech ventures. The absence of relevant expertise in the core team could pose challenges in executing the project successfully.

4. Timing and Market Trends

Worldcoin’s listing on major exchanges and the associated buzz can lead to a temporary spike in its price. However, history has shown that Binance’s listing often signals a local top for many coins.

Until the overall cryptocurrency market enters a bull phase, Worldcoin’s price might face limitations, struggling to rise above a threshold of $3.

5. Unconventional and Controversial Idea

Worldcoin’s concept may be intriguing, but it also veers towards the bizarre and controversial side. Similar startups with unconventional approaches have often faced uphill battles and a high failure rate.

Also read: 10 Best AI Tools For Online Business

Investors should be cautious about getting lured in by an appealing idea without considering its practicality and real-world use cases.

6. The Ongoing Crypto Market Situation

The crypto market’s performance over the past eight months has indeed been positive. However, it’s essential to acknowledge that the bear market might still linger until Bitcoin’s halving event in 2024.

This lingering uncertainty in the market could impact the growth and potential profitability of new projects like Worldcoin.

7. Intense Competition

The cryptocurrency space is highly competitive, with thousands of projects vying for attention and investment. Worldcoin must stand out amid the crowd and demonstrate its unique value proposition to attract investors.

This intense competition poses a risk, as investors might opt for projects with more established track records or more promising prospects.

Is Worldcoin Worth It?

While Worldcoin garners significant attention and is backed by high-profile figures like Sam Altman, retail investors must exercise caution before investing. The extreme initial market cap, imbalanced tokenomics, Altman’s lack of crypto experience, timing concerns, and fierce competition all raise red flags.

Before succumbing to FOMO, it is crucial to thoroughly evaluate the project’s fundamentals and long-term potential. Remember, prudent investment decisions are made based on careful analysis rather than impulsive reactions to market hype.

While Worldcoin may have good intentions, many factors indicate that the value of this cryptocurrency is likely to continue to fall. However, the right integration of this project into the world and the crypto bull market could send this coin to at least $10.